9 Pillars of Mobile Application Development for the Banking Industry

Developing a mobile app for any industry is a serious undertaking, but in banking, it can be especially challenging because of the need to consider so many different technologies. Cybersecurity, online payment solutions, authentication, UX/UI and many other elements must integrate seamlessly for a banking app to be both functional and competitive.

What does it take though, to hit the home run in banking app development? How can you, as a decision-maker within a bank, ensure your app performs precisely as per your expectations, and those of your customers?

When communicating your requirements to a team of banking app developers, there are a few fundamental principles, or pillars, to keep in mind. Nine of those pillars, which you might consider the real load bearers, are outlined below, and your communication should leave the development team under no illusion as to the importance of these foundations.

1. Security

In mobile banking application development, security might well appear to be a matter of common sense. But remarkably, apps qualifying as front-runners in the use of security technology are not prevalent in the banking industry.

Furthermore, it’s not always about the app’s code. If you don't personally pick the mobile banking app developers for your project, discussions with your provider must stress the need for security both in the programming and among the programmers.

An app may ostensibly be unbreakable once released, but when you are not in direct control of the development, you never know what coding practices the team members followed. Any breaches in discipline among the team could invite weaknesses in banking app security. It may not be a likely scenario, but when millions are at stake, there is little room for complacency. In short, you must ensure that a solid security-first ethos exists across your entire project team.

Security from the Customer Perspective

Of course, security is a multi-dimensional issue. For instance, many banking consumers lack an understanding of online mobile security—or its practical use. According to a 2017 report from Pew Research Center, only 52% of American adults use two-factor authentication, and a quarter use simple, non-secure passwords because they feel they will not remember more complex ones.

Statistics like these highlight why it is essential, when engaged in enterprise mobile application development for banking, to consider your end-users—and even do their thinking for them to some extent. Ideally, you will take control of app security out of the hands of your potential users, which could mean using two-factor authentication by default, even if that loses your app a few points for usability in some scenarios. The important thing is to reduce the human element in security control to make your app’s defense more robust.

Other best practices for banking app security include:

- Avoiding local storage of sensitive information on the user device

- Using SSL for any communications between the bank’s app and its servers

- Implementing biometrics or voice recognition to enhance security

- Including automatic log out after a period of user inactivity (don’t even provide the option to disable it)

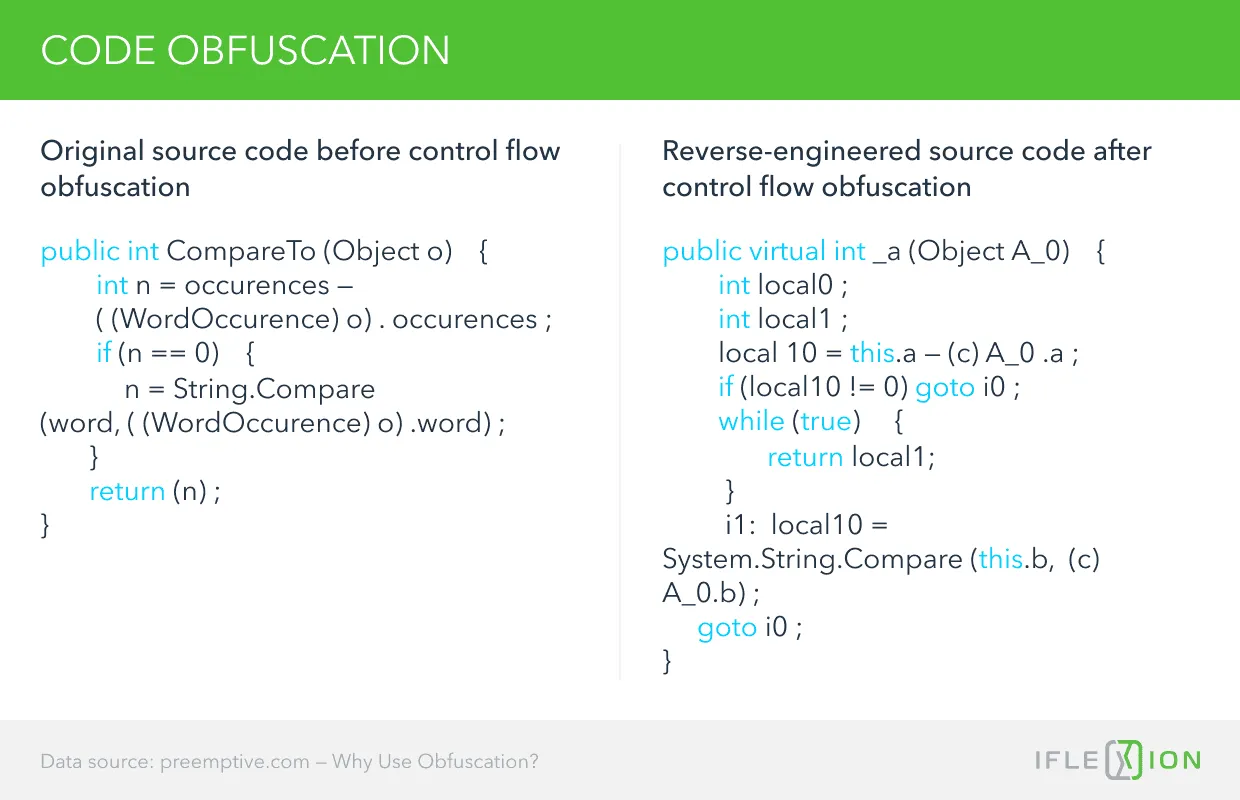

- Obfuscating the app’s code during development to deny unauthorized visibility of its inner functions (see image at the end of this section)

Adding a text notification for every transaction performed with the banking app (so users gain immediate awareness of any unauthorized transactions)

2. Future-Proof

If you compiled a list of security and other technical requirements for your banking app more than a couple of months ago, it’s likely to be outdated already. Thousands of security breaches happen around the world every year. Hacking and intrusion methods continue to grow in sophistication, and the use of artificial intelligence for nefarious purposes may be just around the corner.

In a Daily Dot article published just last year, one spokesperson for IBM suggested that AI-powered malware might already be in the hands of criminal organizations. Even if that particular fear proves unfounded, financial institutions have every reason to ensure apps are continually at the forefront of cybercrime countermeasures.

Consider Industry Evolution

Regarding your app’s underlying technology, functionality, and features, it is crucial to account for obsolescence when sharing requirements with banking app developers. It’s either your job or theirs to make sure the technologies deployed stretch beyond industry standards, and enable your app to remain relevant, not just now, but at least into the near future.

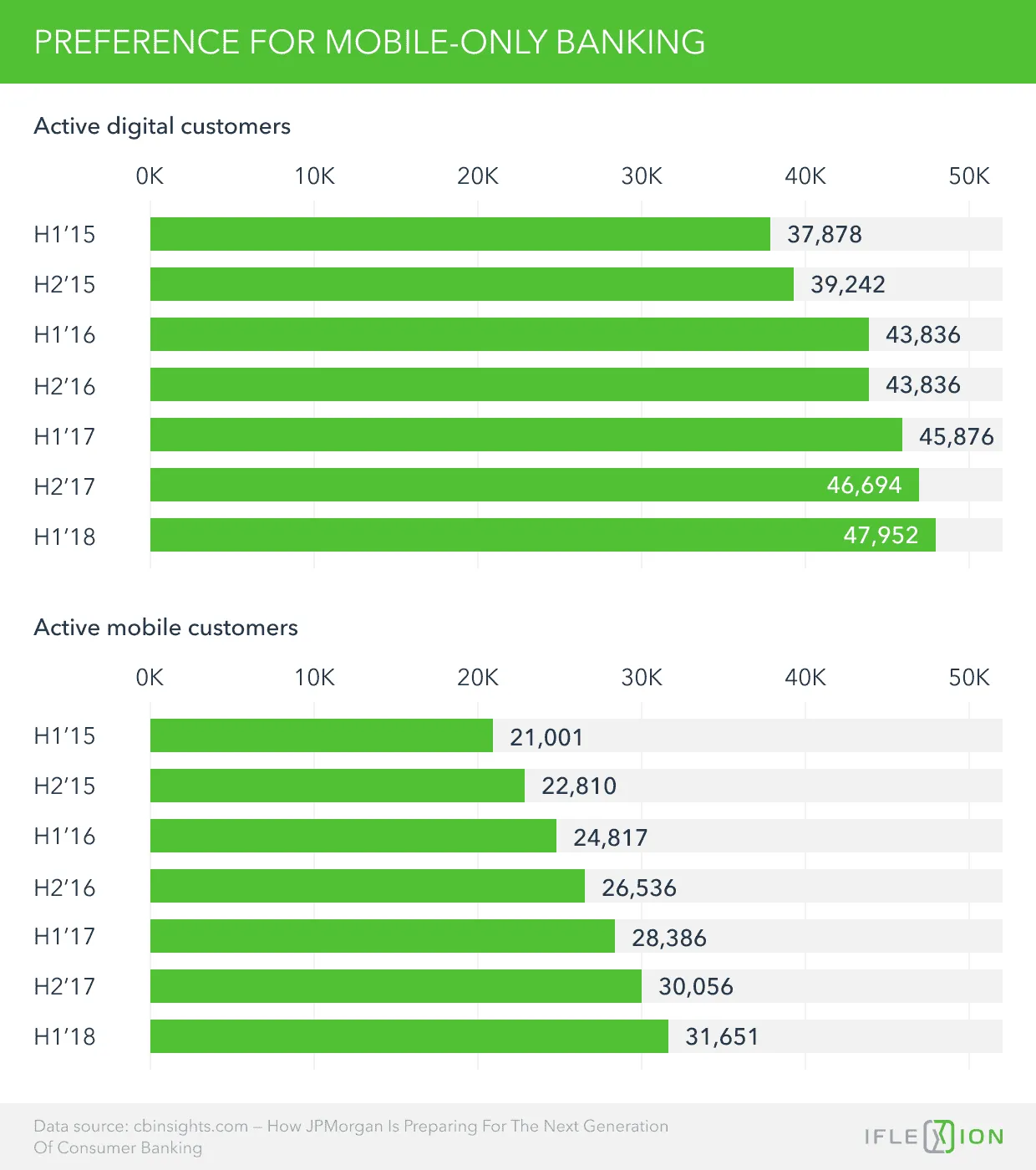

For example, it is clear enough that traditional banking is reaching the end of its life cycle and that a different future is unfolding for financial services. With fintech companies taking over more banking services, maintaining the ability to compete with these upstarts is imperative.

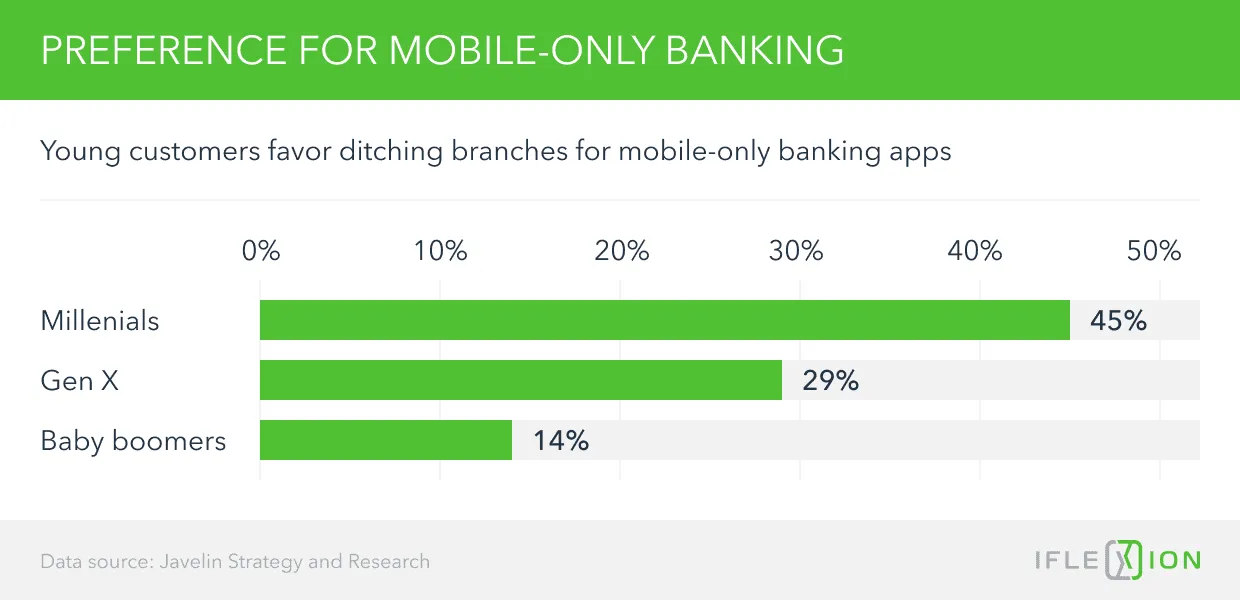

A banking organization has to follow the market, and the market tends increasingly towards convenience, accessibility, mobility, and functionality. Millennials in particular are increasingly shifting away from branch banking and embracing mobile-only banking (as indicated by the graph below). If your new banking app doesn’t reflect that tendency, it’s already obsolete, even before it gets to the preferred app store.

3. Competitively Differentiated

All banks have at least one or two major competitors in the market. If you are competing with other banks that have apps, then your job is to release a similarly functional product. However, if you want to have any competitive advantage, then follow this formula: competitor + 1 = your app.

It’s quite simple: all the features that are included in the app by your competitor, plus at least one element that makes your product stand out. Of course, you can go ahead and revolutionize the banking industry with an entirely new set of features and products, but that can be an incredibly costly endeavor.

Having the same functionality and adding just a single outstanding feature can have a dramatic effect on your brand and on how potential clients perceive it. That said, mobile banking application development is quite complex, so make sure that this feature is not too taxing for your dev team or the budget.

Focus on Standout Features

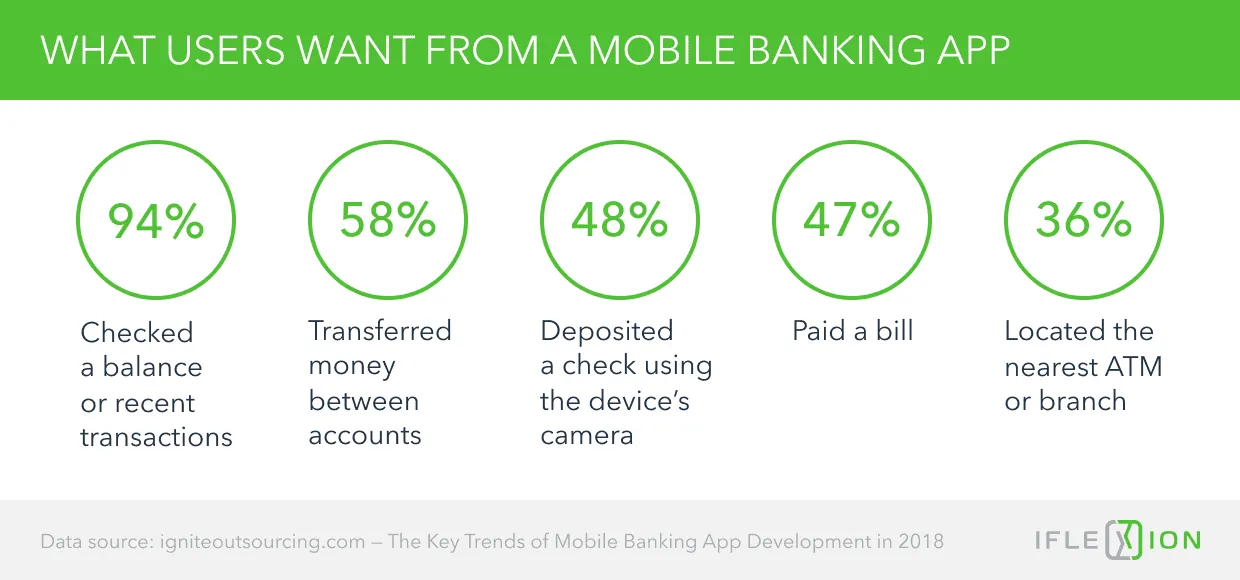

If you are wondering what kinds of features can add the competitive edge to your banking app, all of the following examples, while popular with consumers, are still absent from many mobile banking solutions, so their inclusion in your offering should help it to stand out once launched:

- ATM locator: make it easy for your customers to find ATM services when out and about

- Expenditure tracking and budgeting tools

- Predictive money management

- Investment order management

Cardless ATM withdrawals and purchases: enable withdrawals via QR codes and digital wallets to simplify POS payments

Get secure future-proof banking app with Iflexion's developers

4. Made for Mobile

If your app is very similar in functionality, UI, and overarching logic to your bank’s website, you may struggle to remain competitive. People download apps because they want an authentic mobile experience. They want to manage their money conveniently and with a minimum of screen taps and swipes.

Branding is the only acceptable commonality between your website and your mobile app. Everything else should be minimized, simplified, and decluttered. That is why it’s called an application. It has a specific purpose, but merely serving as an extension to your website and an extra access-channel to your online banking service is to limit the potential value of your app.

5. Personalized

Banks have thousands of customers, and as stated in a research-results article from The Financial Brand, 42% of these patrons increased usage of their bank’s app in the 12 months between 2017 and 2018. Many of these banking consumers would welcome UX improvements, meaning significant opportunities await the brand that thinks big in terms of customer experience.

Sure, copying the competition will get you a functional app, and will at least level the playing field. However, that doesn’t quite answer the user experience requirements from the perspective of your customers. How sure are you, for instance, that your customer base is not demographically different, or does not have completely different expectations of UX than those who bank with your competitors?

There are numerous ways that you can gather information about your customers’ preferences. Your best bet is to identify the customers who use your current app frequently and reach out to them with a carefully crafted questionnaire. Don’t start your mobile banking app development without conducting this type of research and ideally, without defining requirements for meaningful personalization.

What does meaningful personalization look like exactly? Well, to begin with, though banking is a serious matter, it doesn’t mean your company’s app must boast a UI that only an accountant could love. JPMorgan Chase addressed this foible when it launched its app sporting 18 individual, location-based, customizable home screens, as well as adjustable colors and fonts. The app went on to gain wide acclaim as one of the most successful of its kind and to support business growth through the company’s digital strategy.

In addition to features allowing users to customize the app, access to personalized services will also help to endear customers to your mobile banking product. Even the ability for users to tap a button and initiate an instant chat with a helpdesk agent will add a few points to your brand’s personalization score.

A survey by data integration firm Talend identified the importance of such a feature in achieving brand loyalty, when it found that 42% of consumers would break up with a brand if real-time customer support services were lacking.

Other UX enhancements might include:

- Making helpful features—like branch and ATM locators—accessible without the need for users to log in

- Making it possible to turn any main function or feature on and off, so that users can retain only those they use the most, or add and remove elements to suit their needs

- Implementing geo-fenced notifications

- Providing direct access to personal financial advice

- Including functionality for users to schedule appointments at their physical banking branch

6. Combining Offline & Online

Among the many possible banking-app features, those that blend online and offline functionality for their users stand out from the crowd. There is nothing special about the ability to check an account balance using a mobile app, for example. However, when your customers can take a photo of a bill and have that information scanned by the app to use for future payments, your product is reaching into the upper echelons of what fintech apps can offer.

Similar benefits that can help your app to stand out include the ability to deposit checks by taking their photos, being able to update personal information by snapping a new driver’s license or any similar document, and so on.

Indeed, any useful feature or function that can be accessed offline is likely to give your app an advantage against those of your competitors, for which reason it is well worth considering native app development for the most popular mobile operating systems, although it is a more costly approach than building a hybrid or cross-platform app.

You might even wish to evaluate the possibilities of a progressive web app, which may be able to give you some of the on/offline features of native apps with less expense and with the added benefit of needing less space on users’ devices. Since few banks have taken this approach yet, there could be some early-mover benefits to such a strategy.

7. Diverse

Let’s look briefly at the pool of potential users for any banking app. The bulk of them will probably have an iOS device as their daily driver, so their expectations about the functionality and UX are near universal. Then you will have Android and Windows users too, and some customers might even have a BlackBerry.

With such a diversity of mobile platforms to consider, you’ll need to pay special attention to hardware requirements. What runs smoothly on one of the older iPhones might have issues with budget Android devices only because of the hardware differences.

Again, if you don�’t have the budget to build native apps for multiple operating systems, you should consider going for one of the cross-platform banking application development tools, which can save valuable time for your developers. Also, think about the overall size and hardware requirements. It makes sense to minimize the app’s footprint on the hardware by making it as simple and minimalistic as possible.

8. Supported

Even after all the careful planning and execution, there will be times when people are going to get confused by your app, and for some clients, the app might become the primary source of communication between them and the bank.

For both of these categories, and for anyone else who might need your assistance, it’s crucial to include customer care options directly within the application. Earlier sections in this article have touched upon the customer support topic, but of course, backing an app with a full-fledged customer care team is not always a good option, especially for smaller banks.

However, there are other ways to provide a support channel within your application. For instance, many fintech apps now feature chatbots to provide essential automated assistance. You should also make sure that support is easy to find. Preferably, no more than a few clicks away. Otherwise, people will head for your main website in frustration and vent to the support there.

9. Tested

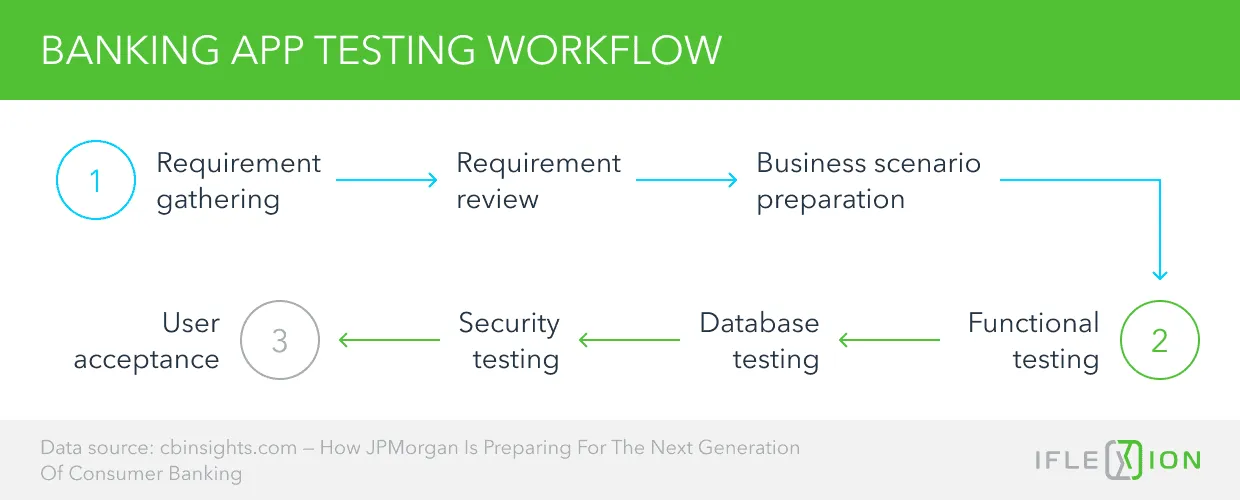

It is critical for any app to undergo a numerous rounds of testing before launch. However, banking apps require even more rigorous testing. After all, they need to support thousands of users simultaneously, integrate with numerous third parties, report user activities, handle large databases, and perform a range of other functions, all of which must perform flawlessly.

For that reason, your testing routines and KPIs have to be as extensive and robust as the actual development process. While it may be common practice in development to save money by cutting corners in testing, it is a false economy to omit any of the typical test phases from a financial app project.

App Testing: An Expensive Essential

Yes, testing is expensive—but it should never be considered optional. You’re paying for the future stability of your product and even for protection against potential legal issues arising from undiscovered bugs, especially if they should relate to data privacy or security.

Testing may be the most monumental effort of your entire project, requiring perhaps two or three times the number of hours used for app development, but it needn’t be especially daunting to manage and monitor.

Just make sure that you communicate your testing requirements clearly to the development team. Above all, do not accept the final product until all of your testing requirements have been executed in full, and you are confident that few if any issues remain.

On a Final Note

Make no mistake; building your app will be a time-consuming and expensive process. Total expenditure can be anything between $350,000 and $5 million. With that in mind, you owe it to your stakeholders to ensure that your product is at the forefront of mobile banking technology. If you base your app on the nine pillars described in this article, you should not go too far wrong, but to be sure these foundations are set before launch, have your IT people go over the app’s code together with the development team.

This collaboration will help to ensure that your IT department understands everything about the final product. It also benefits the developers, as they get to know the people who are going to take over. A smooth transition from development to deployment is the last, but by no means least critical step in cementing the integrity—and success—of your banking app.

Looking for a development partner to check all the boxes?